A Complete Tally GST Guide!

Previously, there were two types of taxes imposed on goods: direct and indirect taxes. The previous indirect taxation scheme imposed some excise duty by the central government and VAT (value-added tax) by the state government, making it extremely difficult to buy and sell goods. GST was implemented to address this issue.

This is equivalent to all the taxes one has to pay at a different level. Each taxpayer is assigned a GST state code. The purpose of GST numbers is to assign a unique label to each transaction so that the tax authorities can properly store their data.

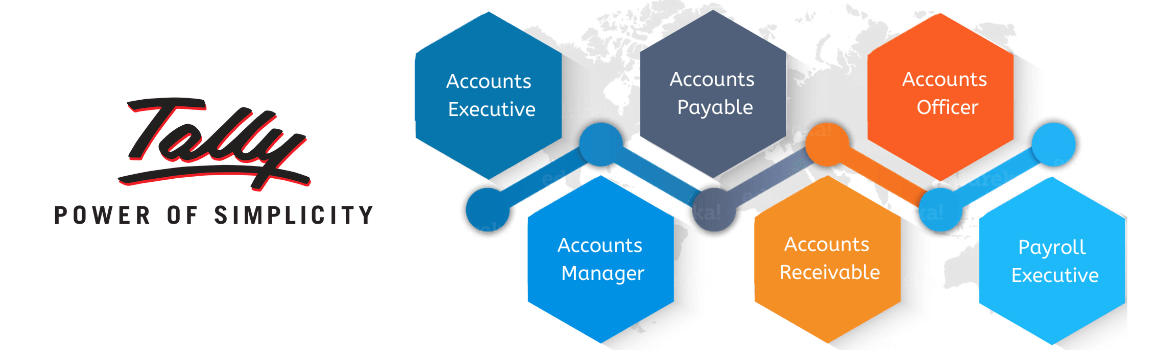

GST-based Tally ERP software was introduced to the market to make the entire process of calculating and storing this data easier. With Tally, GST came many features such as GST classification, which allows details such as the HSN and SAC to be stored under one heading and made available when needed, simplifying the entire GST process.

What are the components of GST?

GST is divided into three parts. The GST process is divided into three stages: state, center, and interstate transactions. So, in Tally, GST entry is done based on which component has levied tax or where the tax goes.

What are the tax types under GST?

There are overall three GST of type-

Central GST- the tax goes to the center, restricted to the state.

State GST- the tax goes to the state, area of sales restricted to the state.

Integrated GST- the tax goes to the center, which is not restricted to the state.

How does GST work in Tally?

GST in Tally is equivalent to VAT, CST, or Service Tax as it was in the old taxation regime's laws. So, here is how the GST works: First, on Tally ERP 9, enter transaction details such as location, value, and GST rate.

The GST will now be calculated using the information provided. Following that, the tax type will be selected, and the accounting entry will be created. Tally will now calculate the tax value for you.