Best Tally Courses with GST Advance

This course is a complete guide to understanding Accounting and the best way to use Tally. The tally is well-known business software. It can handle almost any type of business transaction and provides excellent reporting for business requirements. You will be able to handle accounting and taxation for any reasonable business, as well as prepare MIS reports. We collected real-life useful samples of every type of business transaction in order to gain a better understanding of the useful globe.

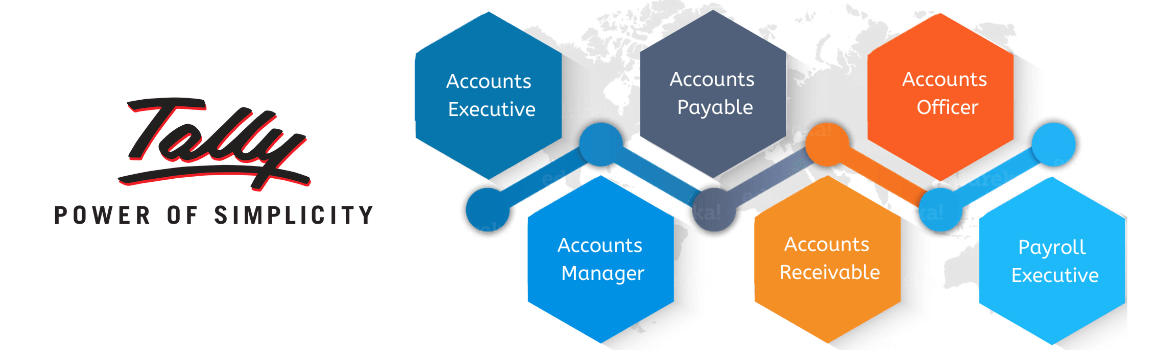

To see all reports clearly, business owners must learn Tally. Working professionals can improve their chances by improving their abilities. You'll be able to start your own accounting firm once you've completed the program. It's an excellent opportunity to advance your career in accounting and finance. Standard Level Major Topics Covered Accounting Fundamentals Accounting and Inventory Experts Accounts Chart (List of Ledger & their usage) Vouchers for Accounting and Inventory Reconciliation of Bank Accounts (Banking) Product and Services Taxation (GST) TCS Payroll, Eway Bill TDS (ESIC, PF, Gratuity) The Advanced Level Expense Center, Cost Category Job Costing Spending plans Price List Exceptional Reports (Accounts Payable & assets Multi-Currency Interest Calculation Purchase, Sales Order Processing Bill of fabric Our Trainer at Attitude Academy having nearly 18+ years of experience in accounts & financing treated big MNCs.

Every business is differing kinds of operations for that reason requires reports are likewise various. As an accountant, you must first understand the business and then record transactions in Accounting Software.